Editor’s note: Seeking Alpha is proud to welcome Luca Socci as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Massimo Merlini/iStock Unreleased via Getty Images

Introduction

Who doesn’t know Ferrari? And who doesn’t know that Ferraris are red? When a company is so powerful to place its products and even its color in everybody’s imagination then we are talking about a world-class premium brand. If we look at BrandFinance’s latest brand strength report, Ferrari is currently the 7th strongest brand in the world, competing with brands like Google, YouTube, Coca Cola and Amazon.

In this article, I would like to explain the reasons why Ferrari (NYSE:NYSE:RACE) is currently a buy.

Ferrari has huge brand strength, which is reflected in its business model that enables the company to steadily grow while continuously passing the price for its uniqueness to the customers. Demand for Ferraris continuously increases and Ferrari shows a stronger company profile compared to its (few) peers. The company makes huge margins and is expanding its product portfolio to address a larger customer base while preserving its exclusivity. As we will see, Ferrari presents healthy financials along with a clear investment policy to preserve its brand value well into the future. Furthermore, this year Formula 1 performances seem to show that Ferrari’s racing team will compete for the Championship, thus giving the Ferrari brand a renewed appeal that seemed to be lacking during the past decade.

Ferrari – A general view of the company

Ferrari owes its fortune to the ability of building supercars for more than 75 years combining superior performance, high technological innovation, and Italian luxury all together. Just to understand how fast the company is running today, as announced during the Capital Markets day in September 2018, Ferrari has shown and unprecedented introduction of 15 new models over the 2019-2022 period.

Furthermore, some surprises are on the verge of being unveiled. It has been announced that by the end of the year we will see the Ferrari Purosangue, a luxury high performance vehicle that will be Ferrari’s first SUV. In addition, the company’s chairman John Elkann has revealed that by 2025 we will see the first all-electric Ferrari. These were his words at Ferrari’s Annual General Meeting in 2021: “We are also very excited about our first all-electric Ferrari that we plan to unveil in 2025 and you can be sure this will be everything you dream the engineers and designers at Maranello can imagine for such a landmark in our history”.

With EBITDA margin already at a stable 35%, we can only imagine this to increase, as electric vehicles have higher margins compared to traditional ones.

Last, but not least, Ferrari doesn’t only produce and sell supercars. Its revenue comes also from selling engines to Maserati and to other Formula 1 teams. In the past years, the company has also started to diversify outside of the automotive industry, leveraging its brand value. There are currently two thematic parks in Barcelona and Abu Dhabi where the iconic prancing horse is seen (and leveraged) everywhere, from the roller coasters to the restaurants and the merchandise shops. In addition, in November 2019 Ferrari hired Rocco Iannone, who previously worked for Armani and Dolce & Gabbana, as Brandi Diversification Creative Director. Among Iannones’ first achievements, we have to consider the launch of Ferrari’s first fashion collection in June 2021.

A clear shareholder structure

During volatile markets and downturns, it can happen that cash-rich investors lay their eyes on high-quality companies to buy them out and take control over them. Ferrari seems protected from this risk as 51% of its voting rights are divided between Exor with a 36% share (the Agnelli family holding, major shareholder of Stellantis) and Piero Lardi Ferrari, son of Ferrari’s founder Enzo Ferrari, who holds 15% of the voting rights. This gives great stability to the course the company wants to run and enables every other investor to clearly know who is leading and running the company.

Growth, marginality and geographical diversification

The past few months have seen investors deal with big worries. First came in inflation and now we are facing the dramatic developments of the Russian invasion of Ukraine.

Although inflation may indeed come under control, as the Fed starts raising interest rates, this situation may prove quite useful to decide what to keep in one’s portfolio. In fact, when inflation soars, it is the moment to see if we are holding highly profitable companies that sell premium products or services which give them pricing power. Ferrari has huge margins with EBIT at 25% of its revenue. If we take into account that at its 2015 IPO Ferrari’s EBIT was 15%, we see a company that is steadily increasing its marginality. No doubt that Ferrari’s cash position has hugely benefited from this, growing from €183 million to €1,344 million at the end of 2021 (an astonishing 634% increase).

Ferrari has a business model that focuses on maintaining volumes low compared to demand. In this way Ferrari always has huge pricing power while also strengthening the perceived exclusivity of its products. Now, if we look at the 2015-2021 period, we will see that shipments increased by 45% from 7,664 to 11,155. Knowing that Ferrari keeps volume low on purpose, we can only imagine how much demand is behind these numbers and how many potential customers are still waiting to receive their first super-car. No surprise that Ferrari declared that its order book has never been so strong, covering well into 2023. We have to literally say: Ferrari is firing on all cylinders. This is a company we want in our portfolio to go through volatile and difficult times as well as during strong economic cycles.

Ferrari hasn’t been idle, but, as we already said, it has widened its product range for a clear reason. The company stated the following in its last annual report:

In the luxury performance car market, a significant portion of demand is driven by new product launches. The market share of individual producers fluctuates over time reflecting the timing of product launches. New launches tend to drive sales volumes even in difficult market environments because the novelty, exclusivity and excitement of a new product is capable of creating and capturing its own demand from clients.

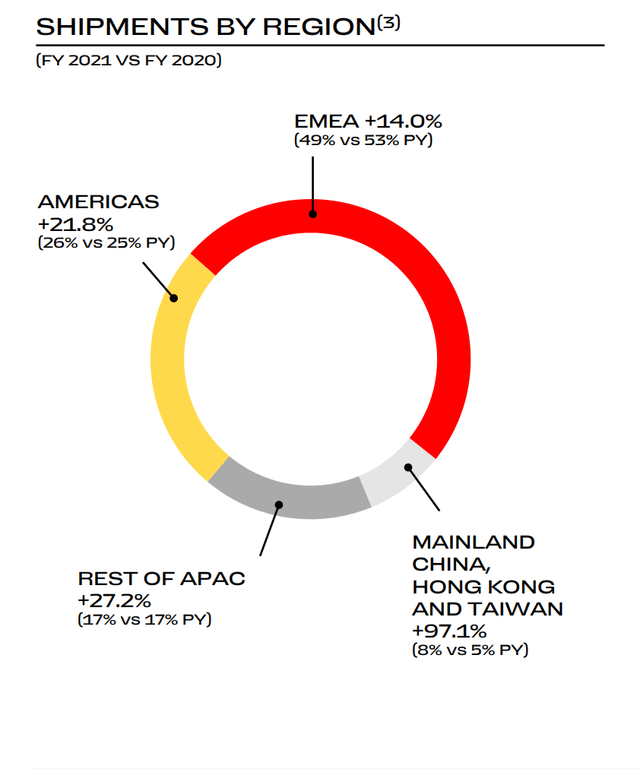

Ferrari is growing everywhere around the world, but as we see from the chart below, it is growing more outside of Europe, which has become, in certain areas, an unstable region due to the Russian invasion of Ukraine and the consequences of this conflict on the neighboring countries.

Ferrari 2021 Results Presentation

Now, in the EMEA region we could be worried about sales in Russia. However, it is significant that 70% of Ferrari’s sales in the region come from 5 countries: Germany, the United Kingdom, Italy, Switzerland and France. The remaining 30% is divided among the Middle-East, all the other European countries, and Africa. Since Russia has never been mentioned as a major market and since we know the book order has never been so strong, Ferrari is a company that will not be affected by the current conflict.

Ferrari in the luxury car market

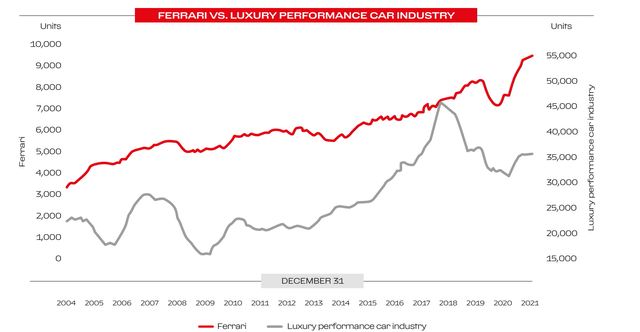

As we said, Ferrari strictly controls its volumes, in order to increase its exclusivity and, as a consequence, its marginality. This could lead many investors to think that Ferrari can’t keep up with a growing luxury car market. However, as the graph hereunder shows, this is not the case with Ferrari. As we can see, Ferrari guarantees a steady growth that doesn’t seem to find any obstacle apart from the Covid lockdowns.

Ferrari vs. Luxury Performance Car Industry (Ferrari 2021 Annual Report)

Ferrari’s steady growth could be, on the other side, too slow in those phases when the market roars such as in between the years 2015 and 2017. In this case, we see that the market grows faster than Ferrari. However, in times of volatility and uncertainty, Ferrari is a more stable company, able in any case to keep growing. But it would be misleading to read this chart only to notice Ferrari’s stability. We do have to point out that in 2004 Ferrari sold around 1,800 vehicles out of the 23,000 vehicles of the luxury car market. That equals to a market share of around 7.8%. Last year we saw that Ferrari just sold around 11,000 vehicles of the 55,000 that made up the whole market. This is a 20% market share. It seems that Ferrari’s steady growth YoY pays off also in terms of gaining market share. We could also read this in another way: it is Ferrari itself that contributes to the market’s growth with its innovation and its new products.

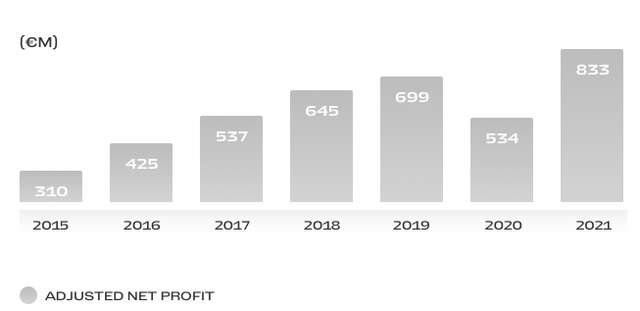

This constant and steady growth can be also seen in this graph, showing Ferrari’s adjusted net profit from 2015, the year of its IPO. The correlation between this graph and the one shown above about Ferrari’s performance in the industry is clear.

Ferrari adjusted net profit growth (Ferrari 2021 Annual Report)

Does Ferrari have competitors?

This question may indeed seem provocative, but, if we consider it carefully I don’t think it is so inappropriate. Ferrari acknowledges as competitors Aston Martin, Audi, Bentley, BMW, Ferrari, Ford, Honda/Acura, Lamborghini, Maserati, McLaren, Mercedes Benz, Polestar, Porsche and Rolls-Royce.

However, if we go through these names we come across very different auto manufacturers. Audi, BMW, Ford, Honda/Acura and Mercedes Benz, for example, do have high-performance luxury cars but on a very different volumes and scale. It is not the same to be the owner of a high-performance Audi or to own and drive a Ferrari. It is also very difficult to compare Ferrari to these brands because the latter build their business in a different way from Ferrari, since they do need volumes and they accept to sell at a lower margin compared to Ferrari.

I don’t even think Maserati is a real competitor for a self-evident reason: they have the same owner. Even though Ferrari spun off from FCA (now Stellantis), it still has Exor as its first shareholder. Exor is also the greatest shareholder in Stellantis. Since they are owned by the same company, it is not likely that Ferrari and Maserati will be pushed one against the other. On the other side, it is important for Exor to cover every market’s segment. This is where Maserati comes into play: it receives Ferrari’s engines and it builds luxury high-performance cars that are just a step below Ferrari.

We could consider Aston Martin, the well-known British manufacturer. Aston Martin was owned by Ford until 2007, when it was sold to David Richards. In 2020, the Canadian investor Lawrence Stroll bought together with a consortium a 25% stake in the company. The first big difference that traces a line between Ferrari and Aston Martin is that the latter currently has an engine supplier in Mercedes-AMG. This, in my opinion, automatically sets Aston Martin at a lower quality level than Ferrari. It is not by chance that Aston Martin is often viewed as a direct competitor to Maserati, which has the same business model of having an engine supplier, as we have already seen.

Let’s get down to some numbers, taken from Aston Martin’s 2021 results presentation, to compare the British car manufacturer to Ferrari.

Revenue in 2021: £1,095 million (about €1,300 million)

EBIT in 2021: £-213 million (about – €254 million)

Free cash flow: £-123 million (about €-147 million)

Vehicles sold in 2021: 6,178

Taking into account that 2021 was a great year for car manufacturers, as the margins increased and the demand was strong, we see that Aston Martin still has some way to go before turning profitable once again. Its guidance aims at selling 10,000 vehicles by 2024-25 with a £2 billion and an adjusted EBITDA of £500 million. Since we are focusing on the EBIT, which is always lower than the EBITDA, we are talking about a company that by 2024-25 thinks it will have an EBIT lower than 25% of its revenue, the point where Ferrari is standing today, in a constantly increasing upward run that we have already discussed.

We could consider Porsche as a serious competitor. However, its annual report gives us some data that enables us to understand that the German supercar manufacturer aims at another segment of the market. In fact, as we read in Porsche 2021 Annual report, in 2021 it sold 301,915 vehicles and generated revenues of €33.1 billion. In other words, it sold around 27x the vehicles Ferrari sold but its revenue is only 7.8x greater. These numbers point out that Porsche is a company (a great one, by the way) that covers a different market segment that, in some cases, may overlap with Ferrari. We can see this by doing a very simple calculation. If we divided the two companies’ revenues by the numbers of vehicles sold we see that Porsche’s revenue per vehicle is around 110k, while Ferrari’s is 381k. We are clearly before two different segments, with Ferrari aiming only at selling high-performance exclusive super cars. This brings me to consider that when a potential customer wants to buy either a Porsche or a Ferrari, it is not by any means proven that the choice is between the two, since choosing one over the other depends on what kind of luxurious high performance car the customer is thinking about and in what market’s segment he or she intends to buy it.

We still have to consider Bentley and Lamborghini. Since, just like Porsche, they are all part of Volkswagen Group, we find some data about them in VW 2021 annual report.

Of course, both companies are not listed individually and so, even though we have to consider them when we look at Ferrari’s peers, we know that, from an investor’s point of view, it will be more difficult to invest directly into them, as one would have to buy VW shares.

Let’s get to Bentley. The British car manufacturer states that its brand is defined by “exclusivity, elegance, and power”. Bentley is perceived as a very exclusive and luxurious car manufacturer. However, it doesn’t have Ferrari’s appeal when we consider performance. Why is that? Even though Bentley produces high-performance cars (its new GT Speed is able to sprint from 0 to 100 km/h in 3.6 seconds), its brand is not so strictly linked to racing as Ferrari is, thanks to its presence in many different racing competitions around the world. In 2021 Bentley sold 14,594 vehicles for a revenue of €2.8 billion and an operating result of €389 million. This gives a revenue per vehicles sold that reaches around 193k positioning Bentley on an intermediate level between Porsche and Ferrari.

I think Ferrari’s only real competitor is Lamborghini. However, as we will see, I still don’t think Lamborghini is as valuable as Ferrari, without even considering that to invest into Lamborghini one would have to invest in VW.

Lamborghini sold 8,315 cars in 2021, up 11% from 7,460 vehicles sold in 2020. Its declared profitability was at 20.2%. Its revenue was the highest ever in its history as it came a little short of €2 billion, reaching €1.95 billion. The revenue per vehicle sold is closer to Ferrari as it is around €234k. However, Lamborghini, even though it doesn’t provide us with all the information a listed stock has to publish, gives us quite an interesting fact that has to do with Ferrari.

Out of the 8,315 vehicles sold, 5,240 were Urus, the SUV Lamborghini launched in 2018. It means that this model accounts for 63% of Lamborghini’s sales. We know that Ferrari, so far, wasn’t producing an SUV. However, as we said at the beginning, Ferrari announced the launch of the Purosangue, which will address the market Urus is covering. From Lamborghini’s data, we know that the demand for this product is great and this must be factored in when evaluating the future of Ferrari.

Ferrari Purosangue (Ferrari)

A possible risk: the EV revolution

We are heading toward the end of the internal combustion engine as we move toward EVs. This is a time to say that the era of internal combustion engine has been won, when talking of super cars, by Ferrari. There is no reason to believe that in the next 10 years a real competitor will come up using this technology. On the other side, we could worry about Ferrari’s future in the EV era. Regarding what will happen, we only know that Ferrari declared that we will see its first electrical supercar in 2025. It is not by chance that last year Ferrari hired Benedetto Vigna, as its new CEO, who comes from STMicroelectronics and the tech world. This is a choice that shows how much Ferrari wants to be led by someone who can guide the company towards the next generation of super-cars.

I also think that Ferrari has proven many a time capable of innovation and technological development. Investors should thus not be worried about the efforts and the quality of Ferrari’s endeavor to turn electric while manufacturing unique super-cars.

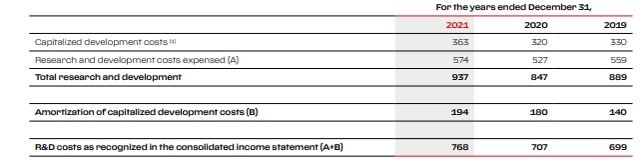

Furthermore, Ferrari is increasing its investments in R&D, announcing in March that it will spend €500 million in its plants in Italy by 2025 to prepare for EV production.

Ferrari’s R&D Investments (Ferrari 2021 Annual Report)

As we can see from this table, Ferrari has the strength to increase its investments year of year, a clear sign of financial health and growing revenues. From 2019 to 2021, R&D costs recognized in the consolidated income statement increased by almost 10%, showing Ferrari’s commitment towards its future.

Keep an eye on Formula 1

When we invest in Ferrari, one of the first risk factors we have to consider is performance in the Formula 1 championship. Since Ferrari owes so much to its brand value of being the best super-car manufacturer in the world, it is of great importance how this is shown in the most followed racing competition of the year. It is not by chance that Ferrari itself says that poor Formula 1 performance is its second greatest risk factor.

As the success of our racing team forms a large part of our brand identity, a sustained period without racing success could detract from the Ferrari brand and, as a result, from potential clients’ 13 enthusiasm for the Ferrari brand and their perception of our cars, which could have an adverse effect on our business, results of operations and financial condition”.

It was 2008 when Ferrari won its last Constructor’s Championship. After that, the Ferrari racing team has not performed well. However, this year may be the turnaround point. In fact, since last year it was well known that, starting from 2022, there would have been some major changes in the rules and the car requirements. Given that Ferrari wasn’t performing well during the 2021 Championship, the racing team immediately started investing to develop the Ferrari F1-75 according to the new 2022 rules. This gave Ferrari a great competitive advantage compared to the other major teams that were racing for last year’s Championship.

The results are encouraging: after 4 GPs Ferrari’s drivers have achieved better-than-expected results. Charles Leclerc won twice and came second once, while Carlos Sainz reached the second and third place each once. Although the Championship has 17 more GPs to go, Ferrari had never started so well a Championship in the past years. If this year Ferrari will be able to win the Driver’s and/or the Constructor’s Championships, its brand value will increase even more, leading to new orders.

A look at Ferrari’s financials

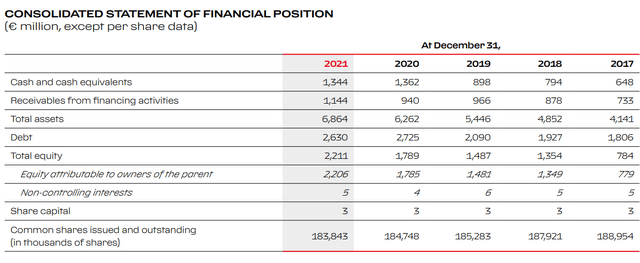

If we look at Ferrari’s consolidated statement of its financial position, we see quite a bit of strength.

Ferrari’s financial position

Ferrari’s Consolidated Statement of Financial Position (Ferrari 2021 Annual Report)

We already talked about Ferrari’s revenue and EBIT growth. Now we have to understand what is Ferrari doing with the earned money. As we can see, the first line shows that Ferrari’s cash position has more than doubled over the past five years, moving up from €648 million to €1,344 million.

However, we also see that Ferrari’s debt increased from €1,806 million to €2,630 million. If we compare the cash growth to the debt, we can notice an interesting fact. While Ferrari more than doubled its cash, it increased its debt only by 45%. We can also notice, on the other side, that, while Ferrari increased its cash by €696 million, it increased its debt by €824 million. This could make us think that Ferrari’s increased cash position is only due to an increase in debt. But if we take a closer look, we see that Ferrari took on a lot of debt in 2020, increasing it by around €700 million as Ferrari issued 1.5% coupon notes due May 2025 (see Ferrari 2020 Annual Report (page 108)). However, if we look at the chart above, we can notice that this year Ferrari started reducing its debt. I think this to be a smart move: Ferrari took advantage of a low interest rate environment to be ready for the next economic cycle. Now that interest rates are rising, Ferrari has plenty of cash to finance its operations and its investments without needing to borrow further money at a higher cost compared to 2020.

Ferrari’s healthy balance sheet is also reflected in its annual dividend and its buyback program. On April 19th, Ferrari paid its annual dividend of €1.362 per share. This was a 57% increase compared to last year’s dividend and a 20% compared to 2019 (Ferrari, out of caution, cut its 2020 dividend to have more cash during the pandemic). Ferrari paid this dividend without increasing the payout ratio, which remained 30%. If we look at the last seven years, we see a dividend with a CAGR of 16.7%. This is a CAGR that clearly beats inflation. I would not consider Ferrari as a classic dividend stock because the yield is low, but I would not rule it completely out of a dividend growth portfolio, given the fact that it is a high quality dividend which comes out of a stable and steadily growing business. In addition to the paid dividends, we have to consider Ferrari’s buyback program. Since January 2019, Ferrari has repurchased €862 million, which is about 2,1% of the current market cap.

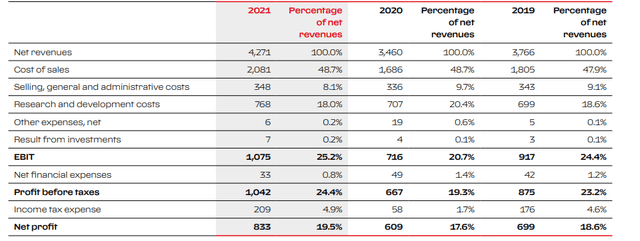

Ferrari’s consolidated results of operations

Let’s take a look at another interesting point that comes from the consolidated results of operations to understand how effectively Ferrari is managed.

The first thing that we can notice is that the cost of sales are very stable in terms of percentages, as they are around 47-48%. If we look at Ferrari’s cost of sales in 2015, the year of its IPO, we see it steadily decreasing, as it was around 58% then. Ferrari is thus becoming more efficient. In addition, we can see from these numbers that the company has the strength to pass on to the customer every price increase it receives from the supply chain. In fact, Ferrari’s cost of sales is not increasing compared to its revenue. I always look at this to understand a company’s pricing power. Let’s get back to where we started: in a high inflation environment, not every company is able to thrive and develop well. Only companies that have very high-quality products with great demand can increase prices without being damaged. Ferrari’s results of operations shown in this chart below shows exactly this: the company is able to make the customers pay for every increase from suppliers.

Ferrari’s Consolidated Results of Operations (Ferrari 2021 Annual Report)

The selling, general and administrative costs are under control as they are in 2021, at the same level of 2019 even though the revenue increased.

Those who want to dive into Ferrari’s annual report thoroughly will also find that Ferrari’s inventories did increase by €80 million in 2021. Usually this is not seen as a good sign, but this must be connected to the specific situation the world is in after the COVID pandemic. On one side, we saw a great increase in demand and revenue, while on the other we still face supply chain issues which make it harder for the inventories to decrease. From my point of view, this number is not worrisome at all, as Ferrari already knows and controls every order in its portfolio well into 2023.

RACE Stock Valuation

Ferrari’s guidance sets a €4.8 billion revenue for this year. We can take this number to be surely reached because, as we already said, Ferrari already knows its order book well into 2023, thus we can be quite sure that its 2022 guidance is accurate. If this revenue is reached, then we could expect the company to breach the €5 billion barrier in 2023. This would mean that in just two years, from 2021 to 2023 Ferrari will have been able to add €1 billion to its revenue, which would mean a +20% increase. In the past, it took Ferrari around 5 years to go from €2 billion to €3 billion from 2011 to 2016 and another 5 years to get to €4 billion from 2016 to 2021. If these numbers are confirmed, Ferrari could reach in 2023, in the conservative case the marginality remains at 25%, an EBIT of at least €1.3 billion, equaling to its actual cash position. We are being conservative, but it would be a 25% EBIT increase which would clearly increase the EPS. If we add that the company has already bought €800 million in buybacks from 2019 to 2021 and that it will continue its buyback program, the EPS will grow significantly.

In my discounted cash flow model, I assumed that in the next five years Ferrari will grow at around 13% a year. I used this number because since its IPO Ferrari has grown at a CAGR of 12%. With the expansion of the product portfolio and the entry into the high-performance SUV space, taking into account the success of Lamborghini’s Urus, I expect that in the next 5 years Ferrari will grow at a faster pace. We have, in fact, to factor in the increase in revenue from the fashion collections and the possible new sponsorships coming from Formula 1. I then expect that from 2026 to 2031 Ferrari will grow at a CAGR of 5,4%. As WACC value I use 7%. With these parameters, my target price for the stock is around $293, which gives us a 30% potential upside from today’s price.

Conclusion

My view is that Ferrari has the strength to face many different kinds of headwinds. Its strong pricing power combined with its business model of low volumes enables it to face inflation without reducing its margins. Furthermore, the company is expanding its brand strength to other activities such as fashion and thematic parks in order to have other sources of revenue outside of its core automotive business. In addition, Ferrari has improved its financials year over year and is focused on expanding its addressable customer base without ruining the exclusivity of the brand. If Formula 1 performance will also improve, as it seems, Ferrari will literally fire on every cylinder it has.